KDI FOCUS Korea’s National Pension: Structural Reform Measures February 21, 2024

Korea’s National Pension: Structural Reform Measures

February 21, 2024

South Korea has been under acute pressure to sustain its National Pension Plan without the risk of fund depletion. Given the looming fiscal threat, this study proposes the introduction of a new pension, a fully-funded system designed to ensure intergenerational equity. This reform aims to guarantee that future generations can receive pension benefits equivalent to the contributions paid and investment returns, without the fear of resource exhaustion. For contributions made prior to the reform, the benefits promised under the existing plan should be honored, while addressing the resultant financial shortfalls of the old pension through separate management and strategic utilization of the general budget to bridge these gaps. This study stresses the urgency of immediate action since the prompt implementation will substantially reduce fiscal stress.

Ⅰ. Need for Structural Reform for the National Pension Plan

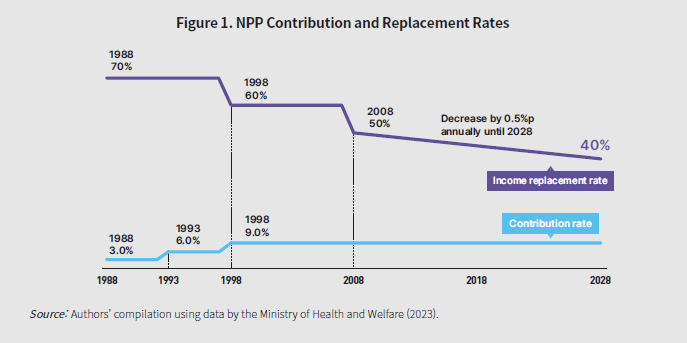

Established in January 1988, South Korea’s National Pension Plan (NPP) initially aimed to emphasize retirement income security in the era of industrialization by setting the income replacement rate at 70% with a mere 3.0% contribution rate. From its inception, this approach created an unsustainable financial base. In response, the National Pension Service (NPS) gradually lowered the income replacement rate to 40% and increased the contribution rate to 9% to mitigate this inherent financial quandary (Figure 1).

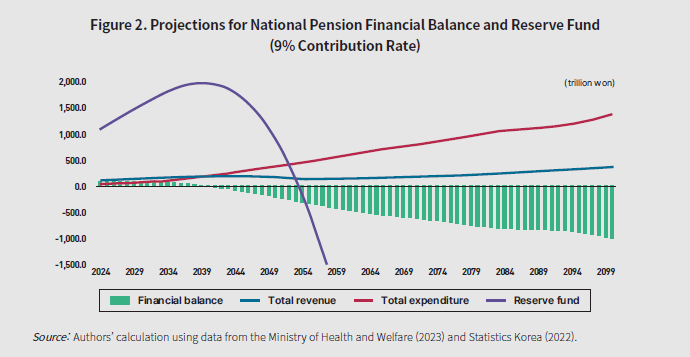

Even with these attempts, the grave financial concerns of the National Pension continue unabated. Assuming the current pension scheme perpetuates, the National Pension Fund (NPF) is expected to face depletion in 2054 after peaking at 1,972 trillion won in 2039 from 1,015 trillion won in 2023 (44.8% of GDP) (Figure 2). This scheme, designed to finance pensions primarily through contribution rate adjustments, would need to increase the rate to about 35% to sustain pension benefits—a figure exceeding the highest public pension contribution rate in the OECD (33% in Italy). Imposing an exorbitant rate at the level of 35% on future generations after the depletion within the existing framework can significantly harm intergenerational equity since earlier generations enjoyed similar or higher benefits with lower contribution rates.

Under the current scheme, South Korea’s National Pension Fund is projected to be depleted by 2054. As a result, subsequent increases in contribution rates will be prohibitively high for future generations.

With several potential solutions put forth to address this issue, pensions expert groups, including the National Pension Fiscal Projection Committee and the Private Advisory Committee under the Special Committee for National Pension Reform in the National Assembly, have mainly proposed recommendations tailored to delay the fund depletion for its financial stability. Such representative proposals relate to parameter adjustments like raising the pension contribution rate. This approach appears to intend to avoid future generations having to shoulder much higher contribution rates after the reserve is drained.

However, without structural reform, adjustments to parameters alone are inadequate to shield the National Pension from falling into intergenerational inequity even amidst efforts to delay fund depletion. Especially given the faster-than-anticipated decline in South Korea’s birth rate, the current pension framework—which relies on a smaller younger demographic to support a larger older one—cannot effectively mitigate this generational challenge, regardless of the extent of parameter adjustments. Take the example of more than doubling the contribution rate to 20%. Although such an unlikely increase can ensure financial sustainability, the unchanged income replacement rate could lead subsequent generations to perceive their pension benefits as disproportionately lower than their contributions and the investment returns of the reserve fund. Coming generations, in particular, might express concerns over intergenerational fairness, observing that their predecessors benefited more from the pension system relative to their contributions and investment returns. Thus, this ongoing rapid demographic shift requires structure reforms aimed at improving equity across generations, beyond parameter adjustments.

Amid rapid shifts in demographic structure, it is essential to undertake structural reforms and adjust pension parameters to enhance intergenerational equity.

Ⅱ. New Pension with a Target Expected Return Rate of 1

One driver of intergenerational inequity within the existing pension framework is the greater-than-one expected return rate of earlier generations. That is the total benefits promised to contributors until death significantly surpass the contribution accumulation and expected investment returns from the pension reserve fund. If funding the excess benefits for earlier generations by anticipated investment returns from contributions by subsequent generations continues, the attainability of a comparable expected return rate for future generations becomes uncertain. Moreover, from the point of fund depletion, guaranteeing even an expected return rate of one becomes untenable. In the end, that preceding generations enjoyed an expected rate of return greater than one implies that later generations face a rate less than one, unable to surpass one over the long term.

While the expected return rate of former generations continues to hover above one, the situation is further exacerbated by low birth rates. A decrease in birth rates initially reduces revenue from contributions, accelerating the fund depletion. Once depleted, the expected return rate drops as a shrinking younger population must support an expanding older population, when compared to higher birth rates. As the birth rate declines, the scale of required contribution rate increases or pension cuts to avert fund depletion grows, thereby keeping the expected rate of return closely tied to birth rates. To tackle this inherent problem of intergenerational inequity within the current pension system, this study proposes pension reforms that can maintain the long-term expected return rate at its maximum level of one, even amidst critically low birthrates. Implementing such reforms requires a preliminary assessment of how to harmonize the existing system with the new framework, involving an analysis of the definition and limitations of the current “partially funded” pension system.

This study proposes pension reform measures that can keep the expected return rate around one, while approaching this target rate is challenging in Korea, particularly due to the sharp decline in the total fertility rate.

1. Fully Funded vs. Pay-As-You-Go, and the Limitations of Partially Funded Pension Systems

A fully-funded pension system accumulates funds through the inflow of original contributions and their investment income from the working-age generations to pay benefits. By definition, this pension funding mechanism ensures an expected return rate of one. In contrast, a pay-as-you-go (PAYG) scheme is unfunded as it does not build up a reserve of assets and relies on yearly contributions. This mechanism has earlier generations finance the pensions for later generations. Korea’s NPP can be currently considered a “partially funded” plan as it accumulates into the reserve of assets and shifts to PAYG upon fund depletion.

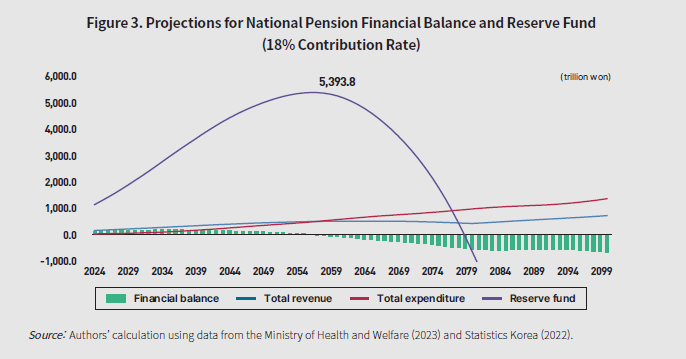

However, considering the structural burden posed by the commitment for an expected rate of return significantly exceeding one (expected return rate >>1), along with rapid demographic changes, the transition of the current partially funded plan to PAYG appears unavoidable. Figure 3 depicts one such scenario of increasing the contribution rate from 9% to 18%, assuming an average annual rate of fund return of 4.5%, a wage growth rate of 3.7% (a 2.0% inflation rate and a 1.7% real wage growth rate), and a long-term population decline rate of -1.5% (a long-term total birth rate of 1.21 persons) based on the NPS’ long-term financial projection model. Per this projection, the NPF is expected to grow significantly, exceeding 5,000 trillion won by the mid-2050s, before facing complete depletion around 2080.

Naturally, there are considerable uncertainties surrounding such estimations. The depletion timing could be postponed due to betterthan-expected investment returns. Nevertheless, given the current economic conditions, the Figure 3 scenario may represent a somewhat optimistic outlook. As Korea expects its potential growth rate to move along a downward path, the investment return rate is likely to decrease further. Moreover, Korea’s long-term total fertility rate (TFR) has been recently revised down to 1.08 children per woman. In essence, addressing public concerns and pushback regarding the dramatic fall in the expected return rate after the fund runs out will be a daunting task.

Provided that the current operation is maintained, increasing the contribution rate from 9% to 18% is likely to result in the reserve fund's complete depletion by around 2080.

In line with the foregoing discussions, this study recommends the introduction of a fully-funded new pension system to guarantee future generations an expected return rate of one, even with exceptionally low birth rates. From the outset of the reform, all contributions will be directed into the new pension’s reserve to pay out pension benefits meeting the expected rate of one. Pre-reform contributions are to be separately booked into an old pension account and disbursed according to the existing formula with a rate greater than one. In this dual-track system, the old pension is anticipated to encounter financial shortfalls (unfunded liabilities) due to insufficient reserves to cover all future benefits. The study proposes addressing these shortfalls through the general budget, independent of the new pension’s setup, with further details to follow in the next section.

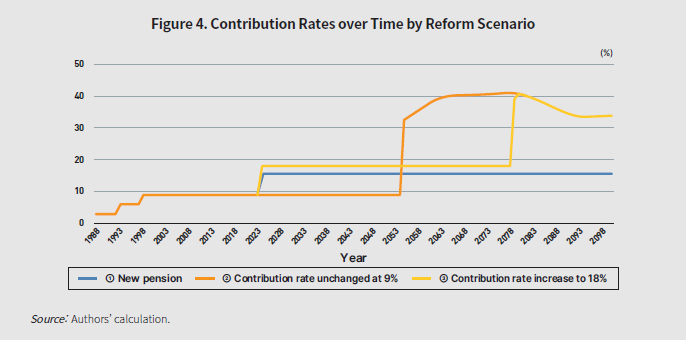

Figure 4 compares three hypothetical policies over time with contribution rate projections required to maintain an income replacement rate of 40%:

① Introducing a new pension system (expected return rate of 1 + unfunded liabilities covered by the general budget);

② Maintaining the current system (contribution rate at 9% + transition to PAYG upon fund depletion);

③ Increasing the contribution rate to 18% (transition to PAYG upon fund depletion).

To avoid imposing undue burdens on future generations, adopting a fully-funded “New Pension” system with an expected return rate one is essential.

In a scenario where the current system stands (②), the reserve fund will be exhausted by the 2050s, requiring future generations’ contribution rate to shoot up to 30~40% to sustain the existing generation’s 40% income replacement rate. Even doubling the contribution rate to 18% (③) would merely postpone the depletion timing to the 2080s so that subsequent generations still need their contribution rate to rise to 30~40%. Hypothetically, if the contribution rate for coming generations is increased to 35% while holding the income replacement rate at 40%, the expected rate of return would drop to below 0.5 (about 0.44 over the long run), which appears to be likely to face formidable resistance.

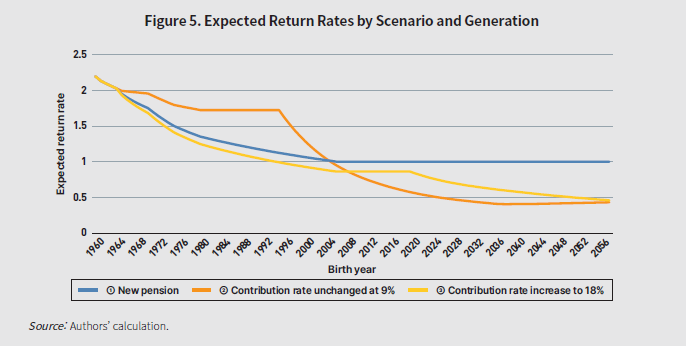

Unlike the reform scenario involving parameter adjustments, a new pension plan with a target expected return rate of one (①) stands out in providing enduring stability to pension finances. In addition, if the new scheme covers unfunded liabilities incurred under the old scheme, estimation shows that increasing the contribution rate to about 15.5% would suffice to maintain a replacement rate at 40% under the new system. By adopting this reform, individuals under the old plan would still experience an expected rate of return above one, as illustrated in Figure 5. However, the shorter the duration of participation in the old pension program, the closer their expected return will converge toward one, initially ranging around two. Specifically, individuals born in the 1960s in their 60s would see an expected return rate exceeding two, while those born in 1974 and aged 50 in 2024 would experience a reduction in the rate to 1.5, and for new entrants to the labor market born in 2006 and onwards, the rate would stabilize at one.

Noteworthy is that under the new plan, future generations would continue to get lower rates of expected return than their predecessors. The persisting generational gap stems from financing the prior deficits with general finances. These shortfalls are unavoidable as the commitments made within the old system, which is inherently flawed, cannot be simply dismissed. Despite this, the new pension design effectively addresses concerns, offering reassurance to future generations wary of shouldering an almost unbearable load (expected return rate << 1) on behalf of retired older generations.

With a 15.5% contribution rate, a fully-funded new pension plan will sustain the current average benefit levels for those born in 2006 and later.

The parallel operation of the old and new pension plans means that the expected return rate gradually declines for each successive birth year, converging to one for those born in 2006 and later.

3. The Burden of Unfunded Liabilities on General Finances and the

Urgency of Reform

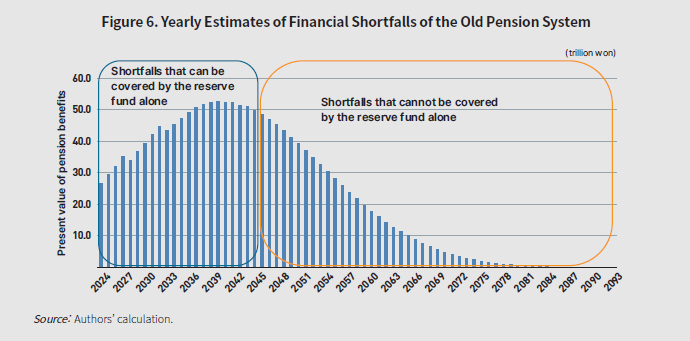

The new pension scheme requires that the general budget absorb the old pension’s unfunded liabilities in order to preempt the discontent of future generations about inheriting these financial burdens. What is the size of such a financial load? With the immediate implementation of the proposed reform in 2024, the present value of the old pension’s deficit (unfunded liabilities) is approximately 609 trillion won, or 26.9% of GDP. Figure 6 details a year-on-year projection of the financial shortfalls, depicting the financial inflow after reserve depletion on the right panel. Starting around 2024, when the old pension reserve is expected to be emptied out, the level of financial burden would amount to 1% to 2% of GDP for the next 13 years. The deficit then is forecasted to gradually dwindle off to near-naught by about 2080.

To support the adoption of the New Pension, it is necessary to consider measures that ensure the general budget covers the unfunded liabilities of the old pension, estimated at approximately 609 trillion won (26.9% of GDP).

Of particular importance, this analysis presents the baseline pace of financial injections. In practice, the intervention should be carried out earlier and more rapidly than outlined in order to minimize the nominal value of the fiscal obligation. Accordingly, incorporating reform proposals activating financial infusions before the depletion of the old pension reserve is worth considering.

Also important is the recognition that delay in enacting reform exponentially magnifies the deficit. Should the pension overhaul be put off until 2029, five years later than proposed, the financial gap is estimated to surge from 609 trillion won to 869 trillion won, or 38.4% of GDP. This exponential increase underscores the greater difficulty of reaching a public consensus on pension reform as the financial obligations expand, potentially leading to a steep rise in social costs associated with postponement. Thus, it is advisable to initiate pension reform at the earliest opportunity.

Since providing general finances early and swiftly minimizes the nominal fiscal burden, it is advisable to initiate fiscal injection before the old pension fund is depleted.

Delaying the reform of the fully-funded new pension plan by five years is expected to result in an additional 260 trillion won in unfunded liabilities that will need to be covered by the general budget.

4. National Pension vs. Private Pension

Critics might argue that the new pension plan, by guaranteeing an expected return rate of one, closely resembles private pension plans, or even question its fundamental necessity. Then, what sets the new scheme apart from private ones that individuals subscribe to safeguard retirement finances? A key distinction lies in the approach to savings. Unlike private pensions, which are subject to personal choice, public pension programs are universally mandated as compulsory savings across most countries. This distinction stems from a global acknowledgment of the role of public pensions in guaranteeing a basic level of retirement income. The experiences of numerous countries have consistently shown that relying solely on individual voluntary savings often results in inadequate retirement funds for a portion of the population to the point of becoming a social concern. In essence, national pensions as a compulsory savings mechanism serve a vital social function, ensuring a safety net for retirees and reducing the burden on social resources.

Furthermore, investment return rates for large-scale funds such as the NPF typically outperform those of private pension plans. A notable illustration is the performance of Korea’s NPF, which has consistently outpaced the market return rate by 11bp over the last decade. However, the size of these funds should be carefully managed so as to avoid excessive administrative costs and prevent undue strains on the private financial market.

While the arguments provided earlier establish a solid policy foundation for the necessity of public pensions, there remains a potential for psychological reluctance among the Korean public toward embracing the new pension. To foster widespread participation despite this reluctance, introducing incentives such as income tax benefits for new pension payouts could be a strategic move.

Even though the expected return rate of public pensions is similar to that of private pensions, the necessity of public pensions for social stability is wellrecognized, and worth considering is the fact that Korea’s NPF has recorded somewhat higher returns than private ones.

Ⅲ. New Pension System: Fiscal Stability Measures, Income Redistribution Function, and Institutional Flexibility

The new pension system, in comparison to its predecessor, stands out for its sustainable financial stability and greater equity across contributing generations. Despite its merits, the transition introduces a set of challenges. Accordingly, this section intends to discuss these aspects, focusing on the new pension’s income redistribution function and the practicality of adjusting contribution rates.

1. Defined Benefit (DB) vs. Defined Contribution (DC), and Preparing for Uncertainties

A question may arise if the existing NPP can address the issue of pension sustainability by substantially increasing its contribution rate to achieve a target expected return rate of one. As discussed before, beyond the public’s questionable receptivity to a significant rate hike, the enormity of uncertainties tied to such decision-making processes is overwhelmingly difficult to manage.

Recognizing the need to accommodate lifecycles into pension plan design, the pension structure should build on solid economic projections over a decades-long horizon. For instance, the design necessary to meet the target contribution rate is built on accurate projections about the fund return rate, mortality rate, wage growth rate, and inflation rate. However, a critical caveat is that even minor inaccuracies can escalate into significant oversights over the long term, increasing the risk of fund depletion. Reflecting on the unforeseen rapid aging and severe drop in birth rate, it is worth considering how many experts had predicted such trends at the inception of NPP in 1988 and subsequent reforms. An economic shift away from initial predictions could spark yet another round of unproductive pension reform debates. Also, repeated reform discussions could erode public trust in the NPS, seriously undermining future dialogues on pension adjustments.

Mitigating these uncertainties calls for a pension benefit formula capable of automatically adjusting to economic and demographic changes. This strategy involves transitioning from the current Defined Benefit (DB) model, which calculates pension benefits early on based on contribution duration and work history, to a Defined Contribution (DC) model. In the new scheme, the DC model determines actual benefits using factors such as contributions, investment returns, and remaining life expectancy. Unlike the DB model, which sets benefits at the onset of contribution, the DC model calculates benefits at the time of disbursement, making it fiscally sounder and better equipped to remain unaffected by long-term changes.

Nevertheless, the DC model becomes particularly vulnerable to financial uncertainties under the specific condition when pension benefit flows are fixed at retirement, precipitated by unforeseen factors, including declines in investment returns, increases in inflation rates, and decreases in mortality rates. There are two additional measures for risk management. The first involves periodic post-retirement reviews of the accrued amount and subsequent adjustments to benefit flows. This approach adapts individual pension benefits in a timely manner, safeguarding financial stability against unexpected economic and demographic changes. Second, benefits are paid based on notional interest rates, which are much lower than real fund return rates, and the surplus is allocated in the buffer account within the new pension scheme. This precautionary measure includes an automatic stabilization mechanism that adjusts overall benefits—decreasing them when the buffer is depleted or increasing them in the event of excessive contribution accumulation—thereby providing a resilient defense against future financial shocks.

With high uncertainties like dramatic demographic changes, bolstering the financial stability of the new pension system requires transitioning from the Defined Benefit (DB) model to the Defined Contribution (DC) model.

2. Income Redistribution Design in the New Defined Contribution (DC) Pension System

The DC model transition raises concerns about the potential erosion of pension’s income redistribution function. However, since the DC pension system extends beyond individual accounts, it can accommodate the integration of income redistribution mechanisms. To further illustrate, this study proposes the Cohort Collective Defined Contribution (CCDC) system, designed to more effectively fulfill the objectives of public pensions. Within the CCDC framework, contributions from each age cohort are pooled into a collective account, separately managed by cohort. The CCDC diverges from the individual account system by reallocating the nominal balances of deceased members to those living within the same age group, thus reinforcing social solidarity. In practice, this means those who die earlier than the average life expectancy contribute their accumulated funds to those who outlive it, thereby enhancing the living members’ average pension benefits compared to a strictly individual account system.

Furthermore, income redistribution can be enhanced by adjusting weights between individual and cohort-average benefits, akin to the existing system. In other words, this adjustment allows the redirection of pension funds from individuals with higher incomes to their lowerincome peers within the same cohort. In addition, an increase in this ceiling amount leads to greater accumulated funds and benefits for higher-income earners, which in turn benefits lower-income individuals by boosting the overall pool of redistributable resources. Therefore, a proactive evaluation of increasing the monthly maximum to strengthen redistributive capabilities with the introduction of the new pension is warranted.

Unlike individual account systems, applying a DCtype pension to age cohorts enables the integration of an income redistribution function.

3. New Pension’s Flexibility: Adjusting Contribution and Replacement Rates

Even with the reforms introduced by the new pension, there may be a concern that the benefits derived from a future contribution rate of 15.5% may not meet expectations. This concern is valid in view of proposals for a further increase in income replacement rates from 40% to 50% that have already been made. Additionally, grievances from lower-than-expected benefits in the new DC plan due to economic and demographic shifts cannot be overlooked, given mortality rate projections have been periodically overestimated, as shown in Choi (2015). As life expectancy increases, the average benefits under DC pensions tend to decrease, leading to the conclusion that a 15.5% contribution rate may prove to be inadequate for Korea’s needs.

However, unlike the DB model, the DC pension system is built on the principle that the adjustments to the contribution rate directly influence pension benefits, likely leading to greater receptivity to such changes. Admittedly, increasing contribution rates would add to the national fiscal burden, which calls for a broader social dialogue about an adequate level. Nevertheless, compared to the DB system, where benefit levels remain fixed, the potential for public dissatisfaction with higher contribution rates in the DC model may be more subdued.

4. Receptivity to Higher Contribution Rates in the New Pension

In spite of the new pension’s commitment to fiscal stability, the plan will likely lead to lower public resistance compared to the current DB scheme. Nevertheless, a one-time hike of 6.5%p in the contribution rate from 9% to 15.5% could still impose a significant burden on contributors and impact the national economy at large. In light of these challenges, this study proposes a more measured approach: incrementally raising the rate first to 12% and then to 15.5% or alternatively, by 0.5%p annually over 13 years. However, without increasing the contribution rate in tandem with pension reform, there is a risk of exacerbating financial shortfalls, especially if the replacement rate remains similar to the current system level. Therefore, initiating and facilitating a broad-based social dialogue is essential, focusing on how the increased contributions should be shared between employers and employees and determining the government’s role in bridging financial gaps that arise. Such discourse is vital for enabling informed decisions that balance fiscal realities with the public’s expectations and needs.

In a new DC pension system, it is possible to adjust the income replacement rate through modifications to the contribution rate.

Ⅳ. Conclusion and Summary

Increasing the contribution rate is indispensable for ensuring the sustainability of the current pension scheme. However, it seems nearly impossible to solve the issue of fund depletion with a rate increase acceptable to the Korean public. Even with such an increase, it would be difficult for future generations to receive pensions proportional to their contributions (expected return rate of 1), as long as the existing pension structure remains unchanged. Accordingly, pension sustainability in step with demographic shifts and intergenerational equity requires a new pension system that operates on a fully funded basis and is capable of securing an expected return rate of one. This study recommends the following more detailed reform measures:

(1) Phasing out the existing pension system at a predetermined date;

(2) Covering the unfunded liabilities of the old pension system, approximately 609 trillion won, with general finances;

(3) Launching a new pension system that ensures an expected return rate of one;

(4) Designing the new pension system around a Defined Contribution (DC) framework to ensure financial stability; (5) Incorporating a Cohort Collective Defined Contribution (CCDC) approach within the new pension system to enable income transfers within the same cohort, thereby maintaining the income redistribution function.

This study aims to catalyze meaningful public discussions on the structural reform of the national pension system. It is crucial to expedite the implementation of pension reforms to mitigate the impact of financial shortfalls of the pension fund on general finances.

CONTENTS-

- Ⅰ. Need for Structural Reform for the National Pension Plan

Ⅱ. New Pension with a Target Expected Return Rate of 1

Ⅲ. New Pension System: Fiscal Stability Measures, Income Redistribution Function, and Institutional Flexibility

Ⅳ. Conclusion and Summary

- Ⅰ. Need for Structural Reform for the National Pension Plan

- Key related materials

We reject unauthorized collection of email addresses posted on our website by using email address collecting programs or other technical devices. To access the email address, please type in the characters exactly as they appear in the box below.

Please enter the security code to prevent unauthorized information collection.