Economic Outlook KDI ECONOMIC OUTLOOK | UPDATE 2024.08 August 08, 2024

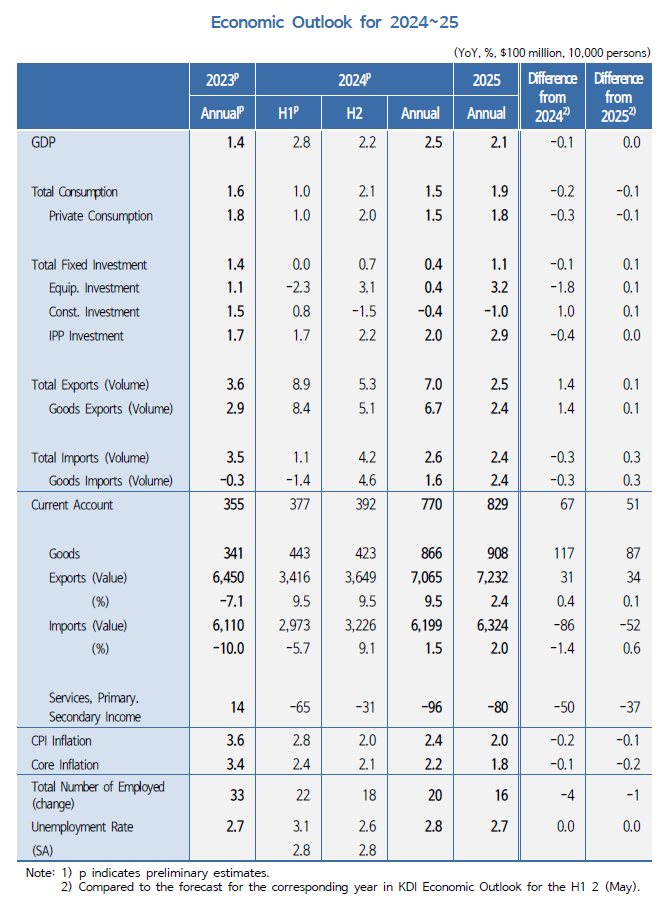

The Korean economy is forecast to expand by 2.5% in 2024, a downward revision from the previous projection (2.6%), as export growth accelerates while recovery in private consumption and equipment investment lags.

- Private consumption is forecast to expand by 1.5%, lower than the previous projection (1.8%), factoring in the protracted high interest rate environment.

- Equipment investment is expected to grow by a mere 0.4%, significantly below the previous forecast (2.2%), as the semiconductor sector struggles to convert its robust performance into tangible investment.

- Construction investment is projected to contract less severely at -0.4% compared to the earlier forecast (-1.4%), with the fallout from real estate project finance distress remaining contained.

- Total exports are projected to surge by 7.0%, exceeding the previous forecast (5.6%), as the semiconductor market experiences more favorable performance than earlier expectations.

- Current account surplus is expected to expand to $77 billion, surpassing the previous forecast ($70.3 billion).

- Headline inflation is forecast at 2.4%, lower than the previous projection (2.6%), reflecting subdued domestic demand and downward revisions in international oil price assumptions.

- Reflecting sluggish domestic demand, the number of employed persons is expected to increase by 200,000 in 2024, revised downward from the previous projection of 240,000.

Ⅰ. Current Economic Conditions

- □ The Korean economy exhibits a deceleration in growth momentum, primarily centered on domestic demand, which had demonstrated exceptional robustness in the first quarter.

- · The second quarter GDP growth decelerated sharply (3.3% → 2.3%), registering a quarter-on-quarter contraction of 0.2%.

- · Amid persistently elevated interest rates, private consumption demonstrated only modest expansion, primarily in goods consumption, while domestic demand remains anemic, as evidenced by decelerating investment.

- · As tepid domestic demand permeates the economy, inflation has moderated, and workforce growth has decelerated, particularly in the service sector.

- · Conversely, exports maintained robust growth, propelled by the semiconductor sector. The combination of export improvement and subdued domestic demand has continued to sustain a substantial surplus trend in the current account.

- □ Externally, the global economy is projected to exhibit modest growth in 2024, while optimism regarding the semiconductor market has significantly strengthened.

- · The forecasts for semiconductor transaction values have been substantially revised upward recently, particularly in the memory chip sector.

- · Concurrently, concerns over economic downturns in China and the U.S. have led to significant volatility in major stock markets and a decline in global oil prices.

- □ Given these domestic and international circumstances, the Korean economy is projected to experience a slight delay in recovery compared to previous projections, as domestic demand is likely to remain subdued while export growth is expected to surpass earlier forecasts.

Ⅱ. Domestic Economic Outlook for

1. Major Assumptions on External Conditions

- □ The global economy is presumed to sustain its moderate growth trajectory in 2024-2025, continuing the trend observed in 2023.

- · The IMF maintained its global economic growth projection for 2024 at 3.2%, consistent with its previous forecast.

- · Global memory semiconductor transaction values are assumed to increase by 76.8% in 2024, significantly exceeding the previous assumption (44.8%).

- □ Reflecting the recent concerns over economic deceleration in China and the U.S., the crude oil import price for 2024 has been adjusted downward.

- · The import price of crude oil (Dubai) is assumed to decline to $82 per barrel for 2024, a slightly revision from the previous $85 per barrel forecast, while the 2025 price assumption ($82 per barrel) remains unchanged.

- □ The Korean won, in terms of the real effective exchange rate, is assumed to remain largely unchanged from recent levels.

2. Domestic Economic Outlook for 2024~2025

- □ The Korean economy is expected to register a 2.5% growth rate in 2024, lower than the previous forecast of 2.6%, reflecting accelerated export growth and delayed recovery in private consumption and equipment investment.

- · Private consumption is forecast to expand by 1.5%, lower than the previous projection (1.8%), factoring in the protracted high interest rate environment.

- · Equipment investment is expected to grow by a mere 0.4%, significantly below the previous forecast (2.2%), as the semiconductor sector struggles to convert its robust performance into tangible investment. Conversely, construction investment is projected to contract less severely at -0.4% compared to the earlier forecast (-1.4%), with the fallout from real estate project finance distress remaining contained.

- · Total exports are projected to surge by 7.0%, exceeding the previous forecast (5.6%), as the semiconductor market experiences more favorable performance than earlier expectations.

- · With export projections revised upward and domestic demand components such as total consumption and total investment adjusted downward, the current account surplus is expected to expand to $77 billion, surpassing the previous forecast ($70.3 billion).

- · Meanwhile, the economic growth rate for 2025 is anticipated to be comparable to the previous projection of 2.1%.

- □ Headline inflation is forecast at 2.4%, lower than the previous projection (2.6%), reflecting subdued domestic demand and downward revisions in international oil price assumptions.

- · The unemployment rate is maintained at 2.8%, consistent with the previous forecast.

- □ Reflecting sluggish domestic demand, the number of employed persons is expected to increase by 200,000 in 2024, revised downward from the previous projection of 240,000.

- · The unemployment rate is maintained at 2.8%, consistent with the previous forecast.

3. Risks to the Outlook

- □ The recovery of the Korean economy could be further protracted if geopolitical risks in the Middle East escalate or if the economies of China or the U.S. experience a sharp downturn.

- · Should geopolitical tensions in the Middle East intensify, leading to a surge in global oil prices, it could exert upward pressure on inflation and downward pressure on economic activity.

- · While there is a high likelihood of gradual economic adjustments in China and the U.S., the possibility of an economic recession cannot be entirely discounted.

- · Additionally, if protectionism strengthens following the U.S. presidential election at the end of 2024, it could potentially hinder Korea's export performance.

- □ Internally, if high interest rates persist despite moderating inflation, there is a risk of delayed recovery in domestic demand.

- · Given the substantial private sector debt accumulation, a persistent high interest rate environment could curtail household spending capacity and corporate investment appetite, potentially suppressing domestic demand.

We reject unauthorized collection of email addresses posted on our website by using email address collecting programs or other technical devices. To access the email address, please type in the characters exactly as they appear in the box below.

Please enter the security code to prevent unauthorized information collection.